The AI Infra Boom Increasingly Looks Like Another Industrial Revolution

Over the past two years, much of the conversation around AI shifted from algorithms to atoms.

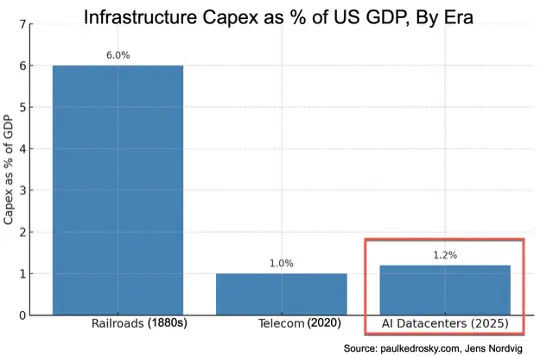

Tech giants are ploughing money into chips, data centers and dedicated power generation at a pace that is materially moving national macro stats. Paul Kedrosky estimates that AI‑related capital expenditure will hit roughly 2 % of U.S. GDP in 2025, enough on its own to add about 0.7% to real GDP growth, already larger (as a share of the economy) than the telecom build‑out.

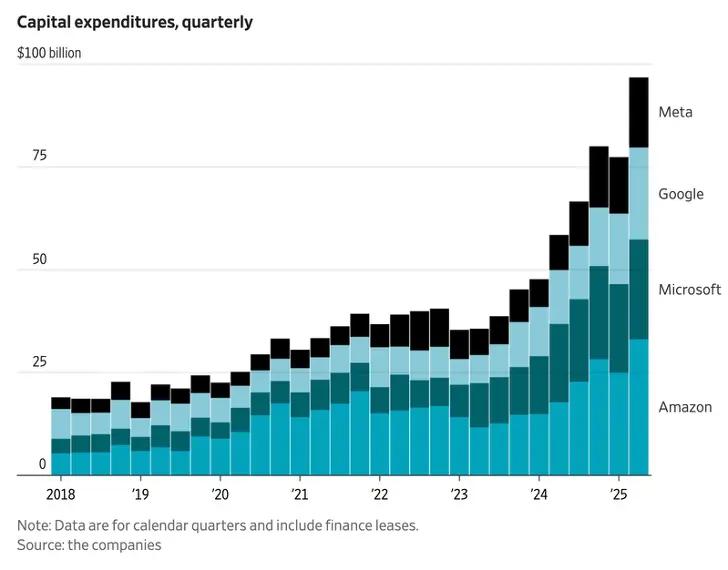

The numbers coming out of individual firms are eye‑popping. In their most recent quarters the “Magnificent 7” spent a record $100+ billion on capex; Microsoft and Meta each devoted more than one‑third of sales to new computing facilities, racks of GPUs and the electricity to feed them.

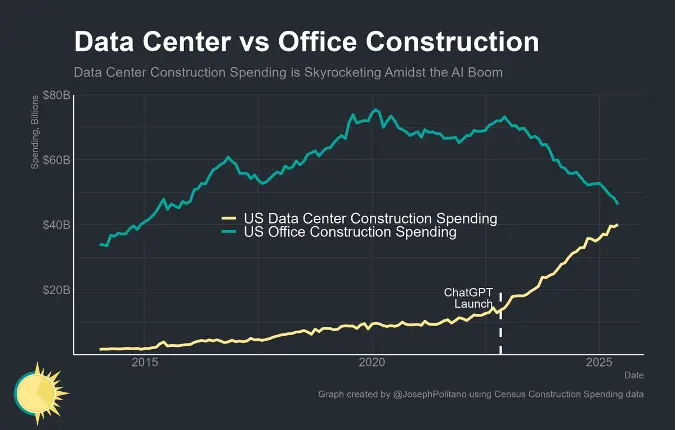

Economists are taking notice of the potential broader implications. MIT’s Erik Brynjolfsson asked on X: “In what year will the U.S. spend more on new buildings for AI than for human workers?” and shared this stunning chart below, which suggests the answer is: “soon”.

Where is all this money coming from? Kedrosky traces six key funding pipes.

• Internal Cash Flows

• Debt Issuance

• Equity Issuance

• SPVs, Leasing, and Asset-Backed Vehicles

• Cloud Consumption Commitments

Noah Smith warns that this shift is siphoning capital away from “everything else” and could plant the seeds of the next financial crunch if highly correlated bets on AI infrastructure sour. If private‑credit vehicles and off‑balance‑sheet leases continue to balloon, an AI demand shock could ripple through banks, insurers, and alternatives investing giants.

The bottom line: AI has graduated from software feature to a massive capital‑intensive infrastructure play that could completely revolutionize the economy.

Whether that sets the stage for a correction depends on (1) how quickly AI capabilities improve with larger models and more test-time compute and reasoning capacity, and (2) how much advanced AI is actually deployed in high ROI use cases that drive economic growth. The former depends on research advances and the foundation model labs like OpenAI and Anthropic, and the latter depends on being able to deploy AI agents in a compliant manner to unleash their capabilities in all regulated enterprises, e.g. financial services, healthcare, energy. Norm Ai is pioneering this second leg with our clients like New York Life.

See Legal & Compliance AI in action

We’ll reach out to schedule a personalized demo.

Central Park AI Forum

Download the Central Park AI Forum pre-read anthology today.